The resumption of student loan payments has become a critical topic of discussion for millions of borrowers across the United States. With the economic landscape perpetually shifting and the implications of student debt lingering over countless graduates, particularly as we gaze into 2025, understanding when and how payments will resume is imperative for effective financial planning. This article aims to elucidate the latest updates regarding the resumption of student loan payments.

The pause on federal student loan payments, originally enacted as a response to the pandemic, has extended multiple times, providing borrowers with a reprieve from what can often feel like an insurmountable financial burden. However, as we transition toward the end of 2024 and approach 2025, significant changes are on the horizon.

As of the latest information, student loan payments are scheduled to resume in early 2025. The administration has indicated that January 2025 will mark the end of the temporary forbearance that has granted relief to borrowers since the onset of COVID-19. While many borrowers may relish the thought of a few more months of non-payment, it is essential to prepare for this impending shift.

In the intervening months leading to repayment resumption, borrowers must begin assessing their financial situations meticulously. Multifaceted factors such as interest accrual during the forbearance period and potential changes to monthly payment amounts necessitate a thorough examination of personal budgets.

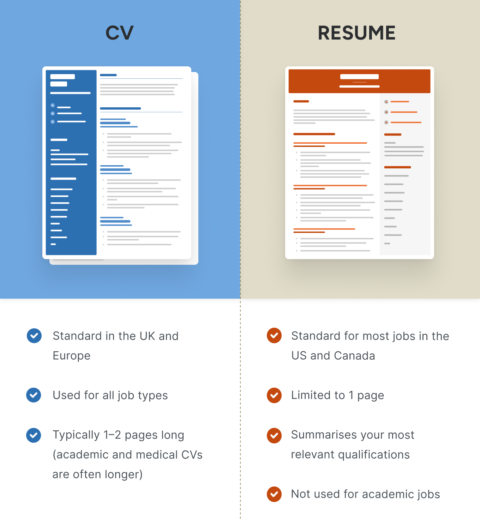

For countless individuals, there exists a palpable anxiety regarding the transition from forbearance to active repayment. It is worth noting that as payments resume, borrowers will face a variety of repayment options suitable to their circumstances. From the standard repayment plan to more nuanced income-driven repayment plans, understanding these options can significantly affect one’s financial flexibility in the years to come.

Income-driven repayment plans are particularly attractive for those whose financial conditions warrant it. These plans cap monthly payments based on discretionary income, ensuring that repayment remains manageable despite fluctuating circumstances. For many borrowers, this option acts as a safeguard against the undue stress of rigid payment schedules.

Additionally, it is important to familiarize oneself with the concept of loan forgiveness programs. The Public Service Loan Forgiveness (PSLF) program continues to be a robust avenue for eligible borrowers serving in public service roles. Graduates may want to explore whether their career paths align with the stipulations of such programs to alleviate the burden of debt permanently.

Equipped with knowledge on repayment options, individuals can also take proactive steps to address the likely increase in their financial commitments. Creating a comprehensive budget that encompasses all monthly expenses, including anticipated loan repayments, can empower borrowers to navigate this transition more effectively. Deliberately setting aside funds in preparation can ameliorate what might otherwise be a jarring change in one’s financial landscape.

The upcoming resumption of payments also prompts the necessity of vigilance regarding loan servicing. The U.S. Department of Education oversees a plethora of servicers responsible for managing loans, and changes within these companies could impact the efficiency of repayment processes. Monitoring communications from your loan servicer during this period is paramount to staying informed about any updates or changes in terms and conditions that might affect repayment.

In preparation for the transition, financial literacy resources proliferate online, offering an array of tools, calculators, and webinars designed to assist borrowers in understanding their debt and repayment options. Engaging with these resources can demystify the complexities of student loans and foster a greater sense of empowerment among borrowers as they confront these challenges.

It is also essential to remain informed about the political landscape surrounding student loans. Legislative changes can reshape the repayment and forgiveness landscape dramatically. Advocacy efforts persist to reform student loan policies, and engaging with these discussions through community or online forums can provide valuable insights into potential changes on the horizon.

As we approach 2025, it is clear that the journey towards resuming student loan payments will not merely be a financial transition but a complicated interplay of emotional responses, economic realities, and systemic changes. With ramifications affecting poverty, access to education, and overall economic growth, the implications of resuming payments reach far beyond the individual borrower. The collective experience of managing debt shapes the narrative of an entire generation.

Ultimately, while the resumption of student loan payments signals the end of a significant era of financial reprieve, it simultaneously opens the door to renewed conversations about the nature of education financing in America. Borrowers are encouraged to use this time wisely, educating themselves, preparing strategically, and advocating for policies that can lead to a more equitable debt relief system. The spotlight on student loans may have dimmed during the forbearance period, but as we head towards 2025, it will once again shine brightly, calling attention to the need for reform and the importance of financial preparedness.