The landscape of student loans has experienced significant shifts in recent years, particularly with the unprecedented pause on federal student loan payments that was implemented amidst the pandemic. As many borrowers now anticipate the resumption of these payments, understanding the timeline and implications is imperative for responsible financial planning. This article delves into the intricate details surrounding the resumed payments, providing clarity and insights that are crucial for current and prospective borrowers.

Historical Context of Student Loan Payment Pauses

The original suspension of federal student loan payments was introduced in March 2020 as a response to the economic turmoil ignited by the COVID-19 pandemic. This temporary reprieve allowed millions of borrowers to alleviate some financial burdens during a time riddled with uncertainty and unemployment. The government’s decision to halt interest accrual and suspend monthly payments was met with widespread relief. However, as the economy gradually rebounded, attention shifted toward the inevitability of returning to payment status.

Current Resumption Dates

As per the latest announcements, federal student loan payments are slated to resume on October 1, 2023. This date marks a critical turning point for borrowers who have grown accustomed to the absence of payments over the past several years. The resumption of these obligations includes the reinstatement of interest rates, which may lead to an increased financial burden for those unprepared for the transition. The Department of Education emphasizes that borrowers should proactively assess their financial situations and prepare for these changes to avoid potential pitfalls.

Impacts of the Payment Resumption

The reinstatement of student loan payments carries multifaceted implications. Borrowers need to rapidly recalibrate their budgets to accommodate monthly payments, which can vary significantly depending on the borrower’s loan type and repayment plan. Notably, borrowers on income-driven repayment plans may find their payments adjusted based on their earnings, highlighting the importance of staying informed about one’s financial standing.

Moreover, the timing of the resumption coincides with a broader economic climate characterized by inflation and rising living costs. These factors may compound the already significant challenges that borrowers face, necessitating an examination of alternate strategies for managing repayment.

Options for Borrowers

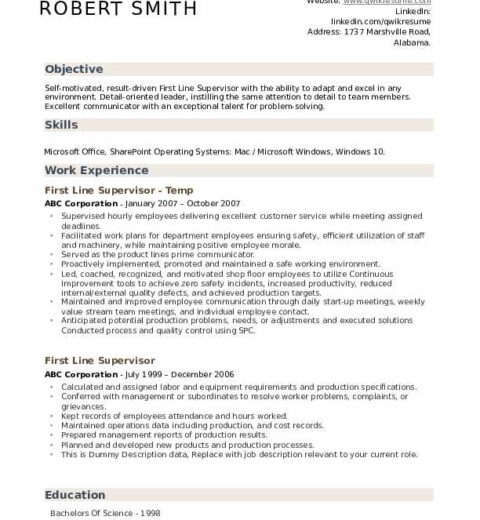

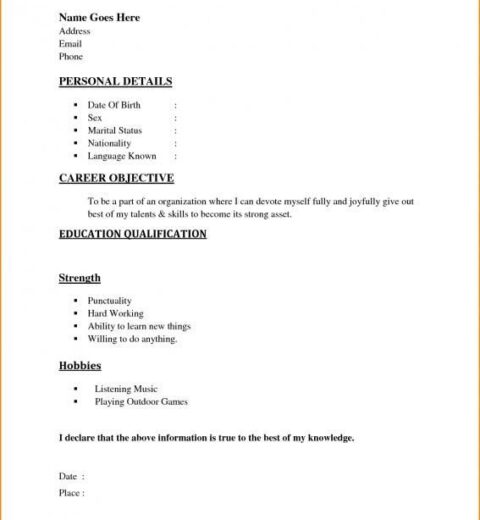

Fortunately, there exists a plethora of options available for borrowers as they navigate this transition. One of the most pertinent strategies is to review and, if necessary, revise repayment plans to align with one’s current financial circumstances. The federal government offers various repayment plans, including graduated repayment, extended repayment, and income-driven repayment plans, each tailored to suit different financial situations.

Furthermore, borrowers should ascertain if they qualify for any forgiveness programs, such as Public Service Loan Forgiveness (PSLF). Engaging with these programs could substantially diminish the financial burden associated with student loans, rewarding borrowers for their dedication to public service sectors.

Managing Borrower Anxiety

As October approaches, many borrowers may experience anxiety regarding their financial obligations. Anxiousness is a natural reaction to the prospect of resuming payments. To mitigate these feelings, it is wise for borrowers to create a detailed repayment strategy. This may include establishing an emergency fund, exploring potential refinancing options, or consulting financial advisors to ensure a holistic approach to their financial health.

Moreover, utilizing resources and tools provided by the Department of Education can equip borrowers with the necessary knowledge to confidently navigate the complexities of their student loans. Engaging in webinars or utilizing loan calculators can further clarify what to expect moving forward.

The Role of Communication

Communication plays an integral role in managing the transition back to student loan payments. Borrowers are encouraged to maintain open dialogues with their loan servicers, asking questions and seeking clarification on various aspects of their loans, including interest rates, repayment schedules, and potential changes to their accounts. Understanding these nuances will ensure that borrowers avoid pitfalls that could arise from misinformation or lack of clarity.

Future Projections and Considerations

Looking ahead, the future landscape of student loans remains tumultuous. Continuous discussions surrounding student debt reform, potential changes in policy, and wider economic conditions suggest that the student loan system may face an evolution—all of which could significantly impact borrowers. Staying informed about these developments will be crucial for borrowers as they navigate impending changes in student loan regulations.

Moreover, it’s essential to consider alternative education financing options. The rising costs of education have prompted discussions about revising traditional student funding models. As more individuals engage in conversations surrounding affordable education, innovative solutions may emerge, providing prospective students with additional avenues for financing their education without incurring substantial debt.

Conclusion

The resumption of federal student loan payments is a pivotal moment for millions of borrowers affected by the unparalleled moratorium. Being informed and proactive will serve as the bedrock for navigating this transition. By understanding the dates, exploring repayment options, and engaging in diligent financial planning, borrowers can transition back into a repayment rhythm with confidence and clarity, ready to confront the next chapter of their financial reality. The future may be uncertain, but preparation and perseverance will empower borrowers to face their obligations head-on.